Henning Greiser, American's Head of International Network Planning, said that the type would likely be used on new secondary markets to Europe while helping to run year-round flights. He was speaking at Routes Americas in San Antonio. He said the type would help increase American's penetration in Europe, especially where it is weak or has no presence of its own.

Niche destinations & new opportunities

American has 50 orders for the A321XLR ('extra long range'), with the first set to arrive in late 2023. The type will be the first actual B757-200ER replacement, more so than the A321LR.

While Airbus touts a range of up to 4,700 nautical miles (5,408 miles, 8,704km), the real-world range of the aircraft will be notably lower than what is proposed, especially with US-bound winter headwinds and depending on American's configuration. A rough range of up to around 4,600 miles (7,408km) is likely.

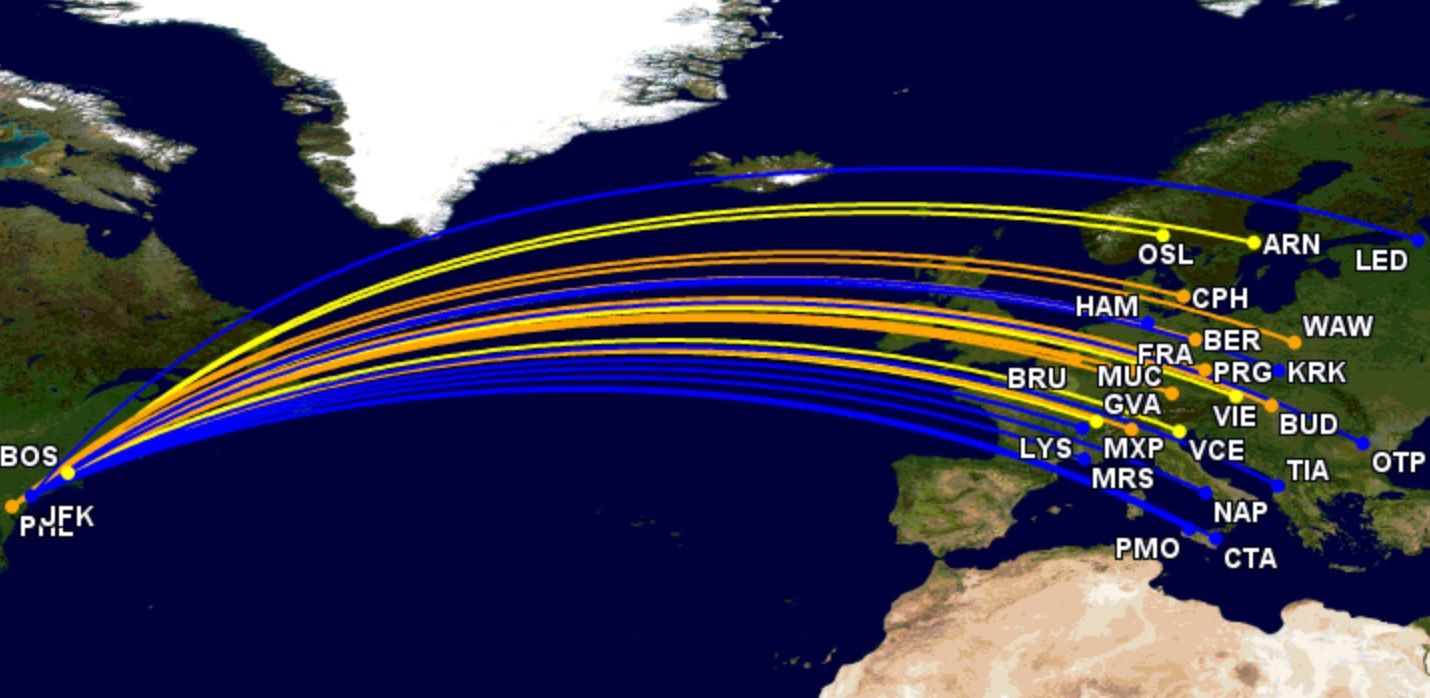

Greiser said the type will be part of its North Atlantic network in summer 2024, but he hopes to use it before then. Because of the XLR's range, it'll probably be used from Philadelphia, JFK, and Boston, with Central Europe cited. Greiser commented:

The A321XLR will open up markets that we wouldn't be able to serve otherwise – new cities and niche destinations that will really work well with our network. Through our hubs, we'll be able to create many one-stop connections that don't exist today.

Will continue its experimentation

Between 2018 and 2020, American added multiple new routes, including Philadelphia to Bologna, Budapest, Berlin, Dubrovnik, Lisbon, and Prague. Others, such as Philadelphia to Casablanca and Chicago to Budapest, Prague, and Kraków were due to begin in 2020 but didn't for an apparent reason.

American was in experimentation mode – until the pandemic hit. While it is currently understandably focused on tried-and-tested mature markets, the XLR will help enable a renewed focus on new opportunities. But it might not be this straightforward.

As the XLR will have far fewer seats to fill versus a widebody, it'll theoretically open up more markets. However, it'll have a higher seat-mile cost than twin-aisle equipment, requiring a higher average fare (but far fewer passengers) to break even. Moreover, the XLR would have a significantly lower sector cost than a widebody, helping to reduce the overall cost and risk of new routes.

Stay aware: Sign up for my weekly new routes newsletter.

But the XLR will have a bigger role

Greiser said the XLR would play an important role in converting seasonal routes to year-round while adding flights in key existing business markets requiring higher frequency. Indeed, in addition to the above, I think the type will have multiple potential roles, including:

- On longer and thinner routes where widebody capacity isn't needed or possible

- To boost performance on underperforming long-haul routes

- In less competitive markets

- Where there is strong enough premium demand

- Where cargo is less important

- Where routes can be right-sized in the low season (fewer seats available relative to lower demand, increasing seat load factor, and better pricing)

- To right-size aircraft on high-frequency services where a particular departure could be replaced by the XLR to help improve performance

Where would you like to see American use the aircraft? Let us know in the comments.